Of recent, word has been spreading about a startup called Safeonline that built a service that merchants within the eCommerce space could use to support pay on delivery orders; did some research on them to find out who they were, very secretive lot. Group of developers turned entrepreneurs but the glue holding everything is an Interswitch alumnus who started his working career as a developer transitioned into product management and finally ending up as Fintech start up.

So what is Cash Vault, what does it do?

Had to do some research first to fully understand definition of escrow, it was then I could fully appreciate exactly what Cash Vault was doing because on first impression thought it was another payment gateway. So what it does is to hold funds debited from a customer for a specified duration so merchant can deliver item customer wants to purchase, if merchant cannot make the delivery funds returned back to the customer.

So how do I use it?

Cash Vault is an API stack of methods that can be used to debit a customer and redeem a code called vault code to disburse funds to account. In summary that is the core element of the service but it is the addition of the other features that make things quite interesting.

So a merchant can assume full control of their own settlement; you can determine when funds is remitted to your account via playing around with a method tagged disbursement amount; also can determine your sharing with no restrictions on sharing parties.

In addition to this merchant can also apply cancellation fees by setting unique attribute for this condition to true in method tagged reservation request, same method used to debit a customer.

Let’s get advanced

When reviewing the rest of the API methods which is catered to mostly reporting noticed two methods Hold Balance and Refund Balance and a little bit of head scratching started; what do I need these two for?

So after some questioning and critique on extra information not being clear enough this is what I came up with.

HOLD BALANCE

Merchant wallet to hold proceed of funds for successfully delivered goods if merchant opts not to want it processed for settlement, “am like seriously you will want that” but the second use case for this is for failed payout attempts which made sense. So if merchant funds cannot be disbursed to designated account credited back to merchant hold balance to support a retry at a later time or disburse to a different account.

REFUND BALANCE

Cancellation fees merchant applies stored in this wallet so when customer refunds occur value returned back less specified fee.

What kind of Support do I get?

API documentation is readily available and you can even play around with some of the methods without writing any form of code; there is also a support blog where you can drop questions which will be responded to by someone within implementation support.

Service supports JSON or XML request payloads so you can consume either as REST or SOAP but I think they are aware no one going near writing code to support SOAP and most of the references within the documentation strictly REST. You can still find information on the WSDL if you are the old school type within the support blog.

No extended support for any checkout management software as of the time I reviewed and if you field requests for sample code likely to be referred to POSTMAN.

What else is there?

Cash Vault comes with an administration dashboard that a merchant can use to enjoy the full benefits of the API stack without bothering about integrating all the service methods sticking with the simple payment gateway type of integration to just support customer debits.

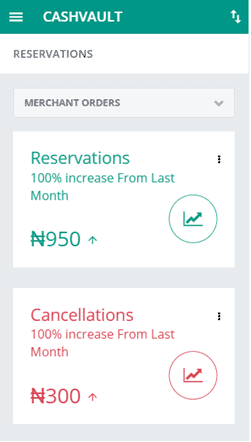

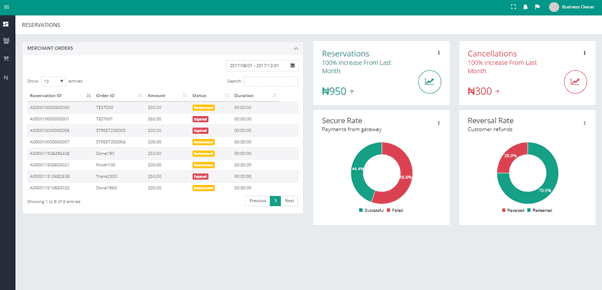

Signed up as a merchant to get a sneak peak of what it looks like

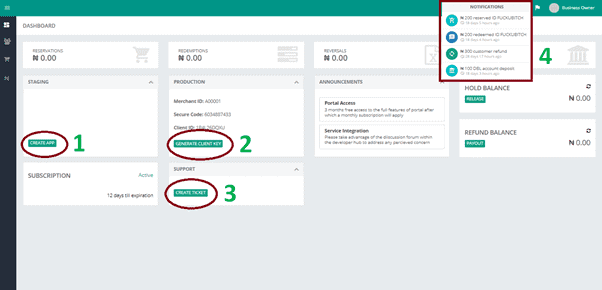

- The pic above is the dashboard from where you can create an app to get test credentials to simulate on your own staging environment

- Generate a Client key when you want to migrate your application to production

- Log a support ticket for issue resolution.

- Notification dropdown to display details of recent activities on your merchant account

You still get a daily overview on your orders obviously as you would expect still yet to process any transactions but it is clearly descriptive.

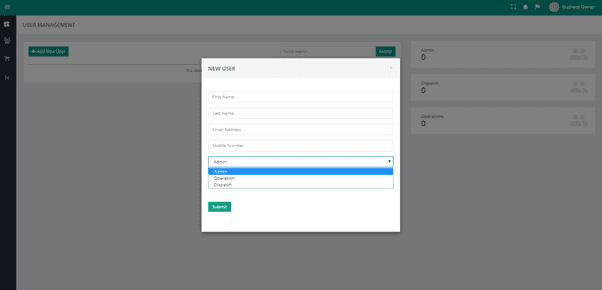

Then there is a user management console needed some assistance in understanding the roles under the option dialog for creating users; so will share

- Business Owner: If you signed up you will likely assume this role and designated sole access to view security token tagged secure code used for authorization of all payouts if your orders not passed for settlement automatically.

- Admin: If you are the busy type you can delegate task of managing users as well as generating client secret key to someone else. For good reasons only admin and business owner have access to generating client secret key for production, one click of that bottom on the dashboard and your key details updated implying if you do not update it also within your code likely to get a lot access denied responses.

- Operations: This role for support representatives on the merchant side to view reports, process redemption of vault code and process payouts. They still need to get authorization code from business owner though.

- Dispatch: The role strictly for the dispatch rider if a merchant has one responsible for delivering goods and collecting vault code from customers.

With the exception of the business owner each role has different views with varying access to different functionality; for example dispatch and admins cannot process payouts so you might need some time playing around with the roles. If DIY not for you no shame in asking for assistance serious.

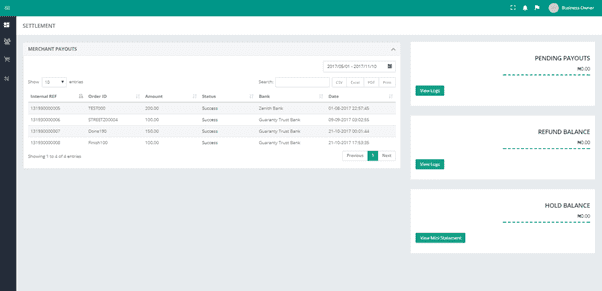

This view provides detailed reporting on your orders with some spice of analytics to benchmark performance within your desired duration. You can also redeem customer orders when it is still pending delivery as well as retrieve customer mobile number to communicate necessary information.

This view just provides more reporting but this time on the disbursement leg; provides information on remitted funds, funds pending processing for remittance, breakdown of cumulative refund balance and mini statement for hold balance. You can also download reports as well.

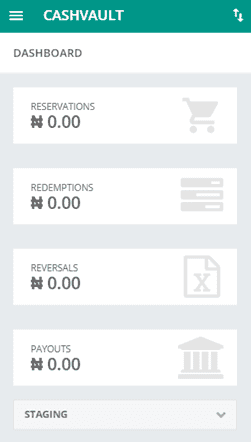

Seems very comprehensive but the best part is that the whole application is responsive so you still have access to all these information on the go.

Finally need to address the disclaimer you will see on the dashboard landing page citing subscription fee will apply after three months, so I asked questions. After the freebie period you will need to pay a subscription fee of N3000 monthly to still enjoy full access but with restricted access you can still create app for testing, generate client secret key for production and submit tickets for issue resolution.