There are millions of companies in the world, both small startups and global industries that have a reach all over the globe. Although still kept as separate entities, it is not unusual for larger companies to buy the smaller ones, which can be hugely advantageous for both parties involved.

Google is an example of one of these business giants. On average, they buy a company every 2 weeks, and these decisions are not always financial. The world looks a lot smaller when you start looking at it like this, with many industries linked together under the large umbrella of the mother corporations.

One reason that businesses like Google might be interested in these acquisitions is they might want to sell the smaller brand’s products as part of their businesses. This is one of the easiest ways that they can expand their product line without having to develop a new product. This way they can reach new markets without worrying about losing any money.

Another common reason for this acquisition is to get hold of the knowledge that the other business may have. This could be in the form of talented employees or general technical knowledge.

For example, Expedia recently purchased HomeAway, a company for rental homes. One might struggle to see at first the connection between a traveling service and home rentals, but then it becomes obvious what a smart, strategic move this is: new service and new expertise are acquired overnight.

If one brand has a very clever team of employees, rather than trying to convince them to shift loyalty and go through the hiring process again, by buying the whole company, they have instantaneously got the whole team.

If you are looking to sell your business to a bigger company, then the key is convincing the buyer why a combination of the two companies together is better than the two companies on their own.

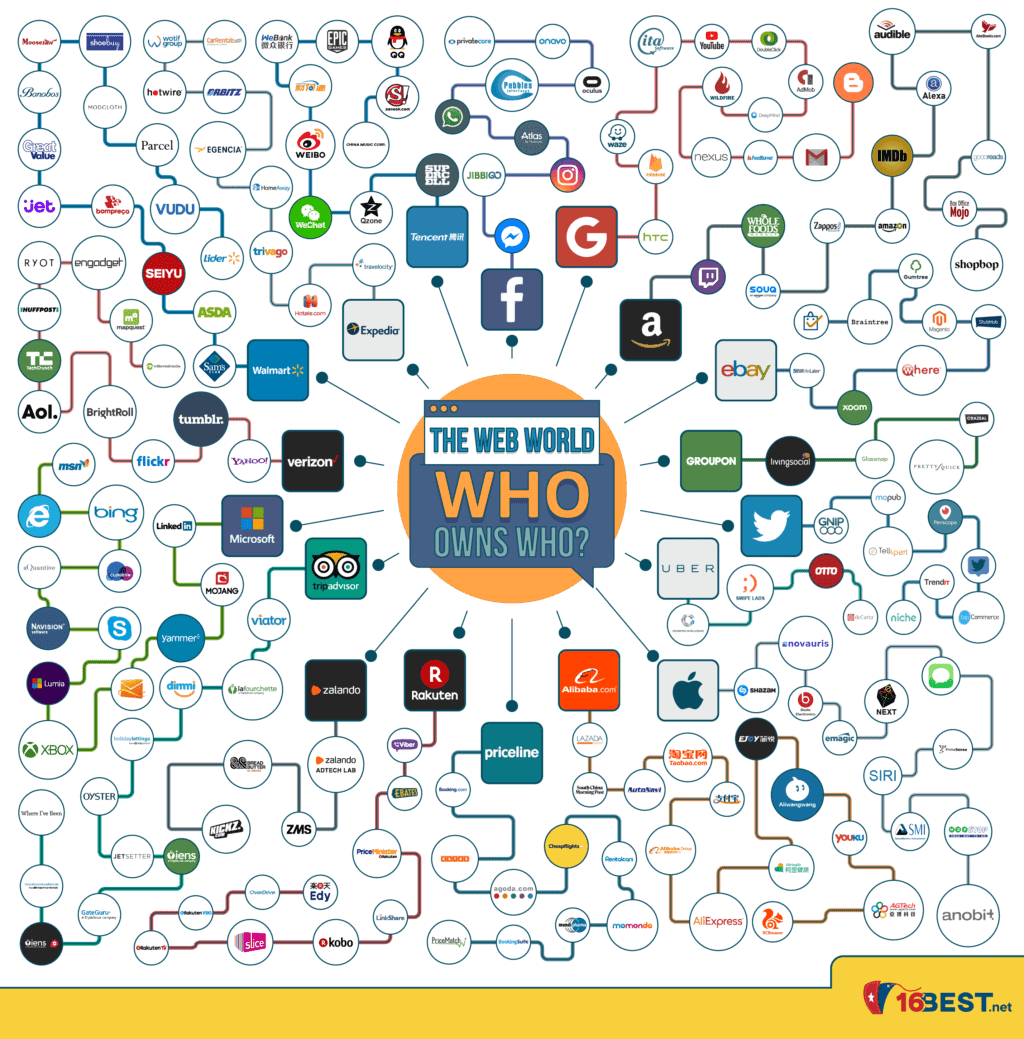

Here is an infographic showing who owns what among tech companies: