The western world developed much faster than the rest of the planet. That saw a lot of technological advancements that was lost on the other parts of the world. With the advent of the internet though, that gap was bridged in some ways.

Then, a new problem arose – transacting financially, and doing so seamlessly.

Even though there are a lot of payment gateways (PayPal, Skrill, Neteller et al), only a few of them could be used by those on the other end of the seas from the founding countries.

Falling into that category a lot, the launch of Paystack came to alleviate a lot of those worries for Nigerians.

What is Paystack?

Even though they are still relatively a start-up company, Paystack is an online payment platform that has made a name for itself in the business of brokering financial transactions between the merchants and customers.

The company was founded in 2015, but launched its product offering in 2016.

Much like the bigwigs in the game from the western countries, Paystack integrates one of the most secure practices obtainable, leveraging that to give vendors the opportunity to broaden the scope of accepting payments.

As of the time of development and writing, the platform is becoming a rapidly developing server for acceptance of credit and debit card payments. Not only in the local market but on a global scale too.

Still qualifying in some books as a start-up, Paystack holds so much promise that it has been able to secure over $10 million in funding from popular names like VISA, Stripe, and Tencent for expansion and even better integration.

Paystack is headquartered in Lagos, Nigeria with about 100 employees working remotely from across 8 countries.

Who are the Paystack Founders?

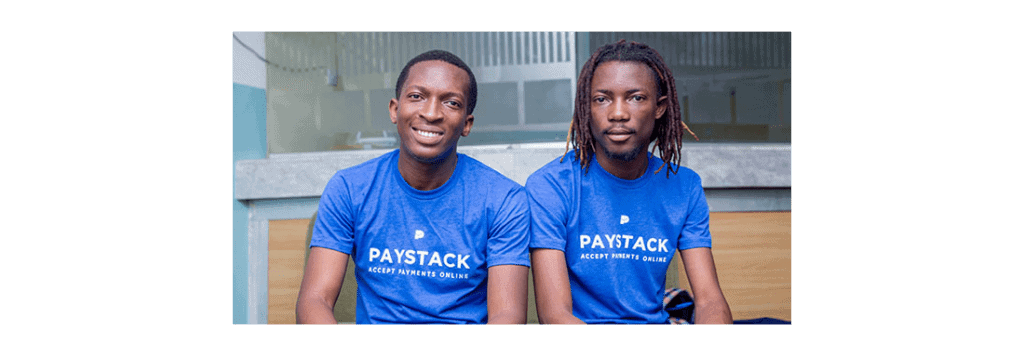

When talking about Paystack, the two names that stand out are those of Ezra Olubi and Shola Akinlade. Their story is even more interesting in the fact that the had neither the financial nor institutional backing to start what is now known as Paystack today.

However, venturing into fintech has proven to be one of the best things that has not only happened to them, but Nigeria and Africa as a whole.

Are my Details Secure on Paystack?

This is a very valid question that everyone should ask. After all, it is your money and you should want to be safe. To that end, I will answer the question in two ways.

First, looking at the company’s operational dashboard, you will see that they operate with a PCI DSS (Payment Card Industry Data Security Standard) badge.

This means that they have been reviewed by the top names in the payment business (the likes of Mastercard, Visa and Verve’s regulatory bodies) and certified worthy of safely brokering transactions.

They even have a token system in place that generates public and private keys for you to secure every payment that goes on through the platform.

The second answer to this question would be made on the trust that people have for them. Having achieved a milestone of more than $1 billion monthly transactions, it is hard to question the safety of such a system.

The case for safety is even strengthened when you learn that more than 60,000 organizations cutting across businesses and government use the service to collect payment online and offline.

Does Paystack Offer Counter-fraud Features?

Sure. Paystack offers a number anti-fraud features that protects both the customers and merchants.

What are Top Brands using Paystack?

If you need more convincing that this is not just another payment gateway from the backstreets, you can find it in the top companies that have taken their business to the platform too.

Some of those top companies are Uber, FEDEX, UPS, MTN, Domino’s Pizza, Jobberman, Hotels.ng, PayPorte, IrokoTV and Gigalayer, to mention but a few. Need I say more?

How Much Does Paystack Charge?

Paystack has different pricing plans in place for customers.

For cards issued by Nigerian banks, Paystack will take a fee of 1.5% and an additional ₦100 on every transaction. However, transactions below ₦2,500, don’t attract the additional ₦100 charge.

For international transactions though, the charge is slightly higher at 3.9%. There is also an additional ₦100 fee for every transaction which will not be waived under any circumstances. Note that international transactions will be processed and remitted to the merchant in Naira by default, but you can also request to be handled in USD.

Business owners can choose to pay the charges themselves or pass it on to their customers. In the later case, all you need do is calculate 1.5% (+₦100 charge where need be) of whatever amount what you are selling is and add it to the final charge.

The payment solution supports numerous channels like debit/credit cards, Bank Account, Bank Transfer, USSD (eg. GTB 737 USSD Banking), Mobile Money, and VISA QR. According to a listing on the website POS payment will be supported soon.

When the customers pay, Paystack takes its cut and you get the intended price. Payment will be delivered to the merchant’s bank account within 24 hours. According to the company, merchants are settled before 10am every morning.

What Currencies does Paystack Accept?

Even though the platform is available in a host of African countries right now, they settle payment in Naira by default.

You can also be settled in USD. However, you will need a GTB or Zenith Bank domiciliary account.

Can I use Paystack for my Business too?

Absolutely.

All you need do is to get a Certificate of Corporation and a Corporate account to match. Even if you had only one of the two, get in touch with a customer representative and you are on your way to accepting payments from anywhere in the world with this system.

Can I Integrate Paystack for Online Payments?

Yes, you can.

In fact, some of the global merchants that are supported by Paystack currently are

- Shopify – You can learn about how to integrate it here

- WooCommerce – Accept payments from anywhere on your WooCommerce store built on WordPress. Here’s how

- Sage – Paystack even lets you update your accounting books when funds come into the business (Coming Soon!) and

- Xero – Yet another accounting tool which Paystack integration works with for easier invoicing and accounting

How Much does Paystack Integration Costs?

Integrating Paystack into your business to receive payments doesn’t cost a dime. The service and support you receive from the company before and after integration comes absolutely free.