OKash is an instant loan app that offers collateral free loans in minutes. It is a perfect platform to get a quick loan if you need some emergency fund. Do you wish to get a collateral free loan? Are you too lazy to get out of the house or just don’t fancy the stress of getting a loan from a bank? OKash Loan App is here for you.

Just download the App, fill in your details, and apply for a loan and you could have the funds in your bank account in minutes.

The good news is that OKash is available for everyone. OKash is a product of OPay that is, Opera Pay and is a micro-lending platform that gives you access to quick collateral free loans.

OKash is available as a standalone app that you can download at the Google Play Store.

Get the OPay App via today via my link and get up to ₦1,200 in reward as welcome bonus.

What is OKash?

OKash is a quick loan app that offers collateral free loans of up to ₦1,000,000 in minutes. It was the result of a partnership between OPay and Blue Ridge Microfinance Bank Ltd.

OKash was one of the subsidiary services that Opera Pay (OPay) offered customers as part of its O universe. There are other services like OFood, OBus, ORide and so on.

In case you are wondering how OKash started. It was first launched in Kenya in 2018 before it spread to Nigeria and other African countries.

How to Apply for OKash Loan

OKash have been hailed for the friendly user navigation that makes it so easy for a user to use the app, and this includes the quick loan app.

Applying for a loan from OKash is very simple.

1. Download OKash App: First thing you should do is, go to Google play store and download the OKash app (OKash is nolonger built into the OPay app in Nigeria). OKash used to be part of the OPay app, but it is now offered as a standalone app on Google Play Store.

So, just click on the install button for the OKash app in Play store and download. Once it is done installing, take this next step.

2. Open the App: Open the newly installed OKash app and sign up with your mobile phone number.

3. Signup/Login to OKash: If you already have an OPay account, you do not need to signup. You can just login with your OPay login details.

4. Accept Terms and Conditions: Read the terms and conditions of the service and if you agree to it, click Continue button to accept the terms and conditions.

5. Confirm Acceptance with a Verification Code: Once you accept the terms and conditions a six digit verification code will be sent to you via SMS to your phone. You confirm your acceptance by entering the correct 6 digit number.

6. Create a PIN: Create a four digit PIN code. You enter the code twice to ensure you get it right.

7. Give Permissions to the Quick Loan App: Next, OKash will ask you to ALLOW your phone to give it location permission. Click on “Allow”.

8. Apply for the Loan: Because you are using the OKash service for the first time, there is a limited amount of loan you can take for first-time. Your first OKash Loan amount can be as low as 3,000 Naira to up to 30,000 Naira, while the tenor of your first loan can be as low as 15 days.

However, as you borrow more and repay on time, you build your credit history which can result in borrowing larger sums up to 1 million Naira and longer repayment time up to 365 days.

The App will show you your current credit limit. Choose the loan amount within your current credit limit that is most comfortable with you and your pocket that you are sure you can pay it back on time.

OKash now offer revolving loans, which means you can now borrow multiple times as long your total loans have not exceeded your current credit limit and you are not defaulting in any of your existing loans.

For example, if your current ₦50,000 and you have already borrowed ₦20,000, and you need ₦15,000 right now, you can apply for the new loan without having to fully pay your existing loan.

After choosing the loan amount, the next step is to choose the number of days within which you will pay back the loan. This is called repay term. The cost of your interest will depend on the repay term.

In practice, OKash seems to calculate the minimum loan you can take. For example, in my own case the minimum was 30,000 Naira, despite being a first time user.

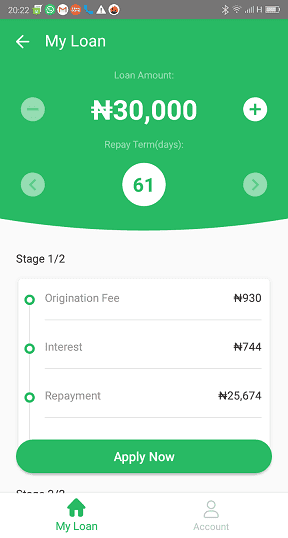

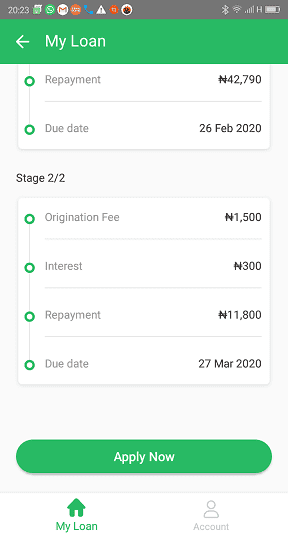

Once you have settled on a loan amount and repayment tenor, OKash will automatically calculate the interest and total cost to show you how much you will pay back and a breakdown of how you are expected to pay back.

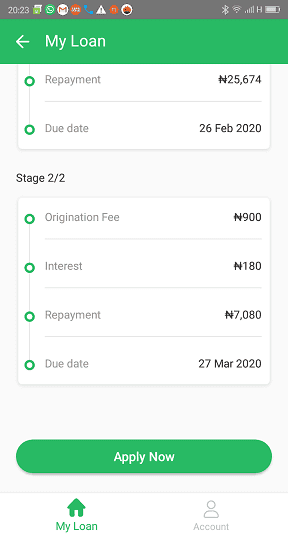

For example, in my on case, if I had borrowed 30,000 Naira on the 61 day tenor, I would be expected to pay back 25,674 Naira within the first 30 days and 7,080 Naira within the next 30 days to complete payment.

So, the total cost of the loan over the 61 day tenor is 2,754 Naira. This makes the effective interest rate 9.18%, although from the breakdown provided 924 Naira is the interest and 1,830 is the originating fee (whatever that means).

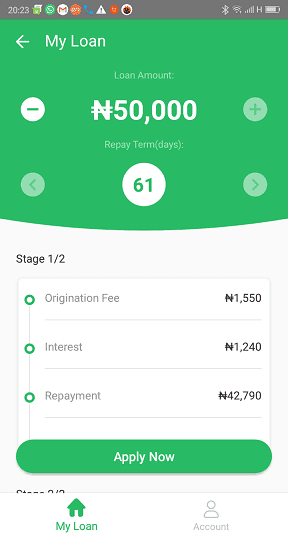

If I had gone for the 50,000 Naira on the same 61 day tenor, I would be required to pay back 42,790 Naira within the first 30 days and 11,800 within the next 30 days to complete your payment.

The total cost of loan here is 4,590 Naira, giving an effective interest rate of 9.18. So, it appears the interest is the same in both cases.

9. Give Reason for Wanting Loan: Next is, you will be asked of your reason for taking the loan. Select the purpose that most suits you.

10. Next step is to click the “apply for loan button”.

11. Then you will be asked of your address, location, calendar and other essential permissions. Give your permissions.

12. Click on “submit” for your loan to get approval.

13. Upload your ID photo or just take a selfie on your phone and upload it.

14. Click on the last “submit” button for your loan to be disbursed to your wallet. It is not an immediate process, so you will need to be patient.

OKash will send you an alert on your phone number informing you that your application is being reviewed. Once the loan is approved, the money will be paid to your OPay Wallet from which you can withdraw to your bank account.

How to Repay OKash Loan

Once, the due date for repayment is near, you will get a reminder message from OKash. Just open the App tap on Repayment for a list of all your current loans with the due loan on top. Tap on Repay for repayment details.

Other things to know about OKash Service

OKash has been lauded by users for their first system of loan approval, this is all due to a dedicated team of staff at OKash. Also, there is 24/7 support available for all customers.

Did you know that within the short period of 3 months, OKash was able to disburse loans worth over 250 million dollars to its users?

Reports have it that OKash lent over $250 million to users between July 20 2019 and September 2019 in three main countries including Nigeria Kenya and India.

The number of people who benefited from this loan galore numbered up to 5 million. This is an amazing feat for any micro lending company especially within such a short period of time. And this was achieved by OKash.

OKash is also in line with Google’s lending app policy and they use technology like credit scores to keep track of user insights, loans borrowed and other important metrics.

Opera company acquired OKash in December 2018 and has just expanded to Nigeria and India in 2019 very recently. It is only in Nigeria that OKash is still a subsidiary service of Opay. Outside Nigeria, that is in India and in Kenya, Okash is an app that stands on its own.

India is currently Okash’s biggest market of the three countries. It has expanded to with an average loan of $50, followed by Kenya of $40 average loan, then Nigeria.

OKash company has disclosed that they wish to extend their services to other countries but they are yet to give us a hint as to which countries specifically.

OKash’s aim is to allow for easy financial aid to people struggling in anyway financially and make it easy for them to apply for loans. And so far so good, they have been able to achieve this aim.

To be a part of this amazing micro lending experience, download the OKash app from play store and follow the instructions given in this article above to start borrowing. It is fast, easy and convenient. We hope we have given you a detailed overview of OKash.

Get the OPay App via today via my link and get up to ₦1,200 in reward as welcome bonus.