Nigerians are in love with cryptocurrencies. The country saw a 210% rise in cryptocurrency usage and trade over the year. This means that in Africa, Nigeria is the country with the fastest adoption of crypto assets, consequently opening opportunities for those looking to make money on the side by trading or looking to make a full-time job trading.

The opportunities are wide open for those entering the market now as Nigeria is also the country with the most number of BTC ATMs in Africa. This is a clear sign that the country’s adoption of crypto is not a trend likely to reverse. Of course, trading has changed over the years, and it is not how it used to be.

Nowadays, the market is so volatile that regular humans are not able to make quick trading decisions. This resulted in the increased use of trading bots by professional and semi-professional traders. These trading bots can be customized to take calculative trading decisions according to pre-set parameters helping to cope with a volatile market.

It is also an inescapable fact that fewer and fewer humans trade the market manually as time progresses. In present times, automated trading is taking over all the asset classes.

The image of a lonely individual sitting in front of four screens showing different charts is becoming a thing of the past. Most of the current market operators customize algorithms and only review aggregated data on their smartphones.

Here is an article written by Remitano on crypto trading and everything you need to know about trading.

The desired Characteristics of a Bot

First, we need to examine some of the features that define trading bots. The most important thing we need to consider is how intuitive the user interface of the bot is.

This means it is easy to navigate the layout, understand the functionalities, and have a suite of tools capable of high customization without too much input.

Second, we need a platform that is capable of implementing various strategies. This could be stop-loss, scalping margins, and others. It also requires a robust backtesting database to test investment positions under historical circumstances.

Third, we need a high degree of security features. The bot must integrate two steps verification, API encryption, and new login notifications. The platform also needs to use up to date encryption.

Next, we must look at the cost of using these platforms. We must consider the fees for trading, the subscription plan, available discounts, and other related questions. A bit that costs too much to operate can negate any gain made by trading.

Lastly, we need to look at the possible exchanges that are compatible with the bot. This means which ones are open to integration using the bot’s API. A larger pool of exchanges means more arbitrage opportunities and more potential profits and a higher degree of liquidity to exchange profits into other coins or FIAT.

The Best Trading Bots of 2024

Now let us share some of the best trading bots available today.

1. Haasbot

Haasbot is the main vehicle of the company Haas Online. It was created by Stephan de Hass and launched in 2014. The bot is one of the oldest around thanks to its high degree of functionality.

The main strategy is trading using pairs of coins or tokens, which can be programmed using a command line or a drag menu. The platform comes pre-programmed with fifty economic indicators such as moving averages, RSI, trend lines, and many more. Right now, it works for Windows and Linux, but sadly, there doesn’t seem to be any plans for OS integration.

The company offers insurance for trades using their platform at an additional cost. It is unclear if data is collected when using the bot as there is no mention of it in their policy.

Haasbot offers integration with over twenty exchanges across the world. These include Binance, Bitfinex, BitMEX, Coinbase Pro, Gemini, Huobi, Kraken, Kucoin, and Poloniex.

It is priced per contract time with lengths of three, six, or twelve months. These are only payable in Bitcoin and vary during the year. The advantage of this is that any person in the world can access the Haasbot platform by purchasing a little BTC.

2. Bitsgap Bot

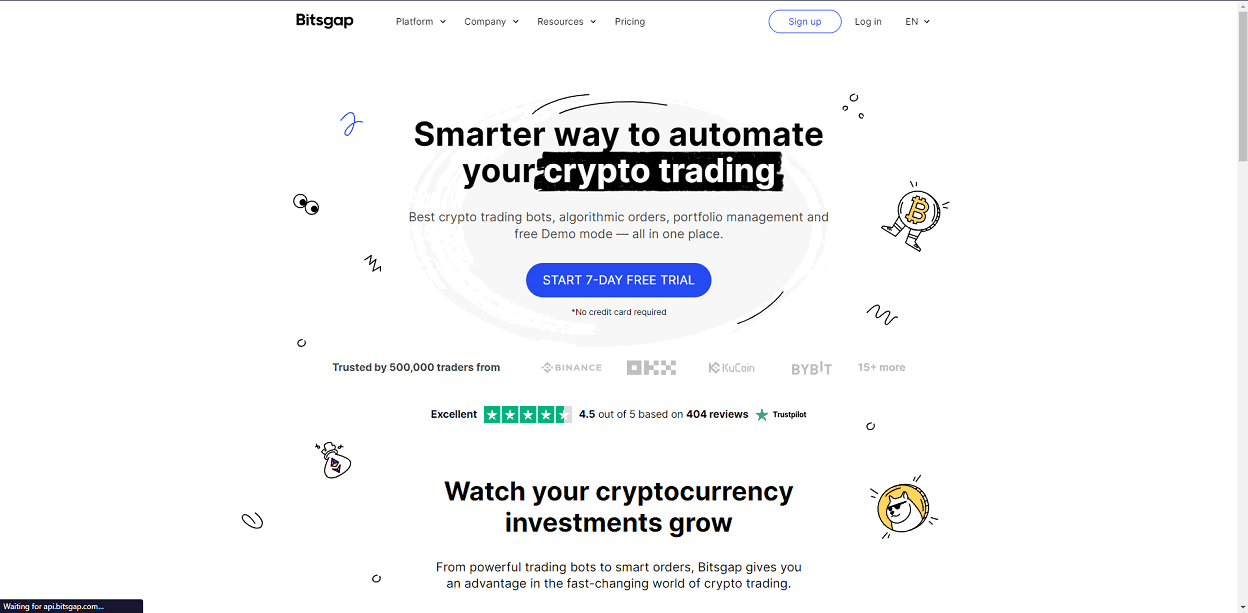

Bitsgap is a trading platform that offers an automatic trading solution with crypto trading bots. Launched in 2017, Bitsgap has grown quite popular with over 500,000 traders currently using the platform and over 3.7 million bots created on the platform.

Through one simple interface, the platform connects to more than 30 global cryptocurrency exchanges including Binance, Kucoin, Coinbase, making it easier to access a variety of markets and trading pairs.

The diversity of exchanges and trading pairs available is also constantly growing, allowing users to connect to their preferred assets. Furthermore, depositing and withdrawing funds is free of charge and without trading fees.

Bitsgap offers different trading bots to enable you take advantage of different market movements. There is a DCA bot that uses Dollar Cost Averaging to invest in crypto at different price levels enabling you out perform the market during bullish, bearish, and sideways market conditions.

Bitsgap also offers Grid bot that enables you make profit from small price fluctuations in either direction. There is also a Combo bot that uses a combination of DCA and Grid to generate impressive profits from more complex trades.

Depending on the plan you pick you can also setup futures bots and trailing bots. Bitsgap plan starts at $29 per month.

3. Instantcoins Ng

The platform just launched in 2020, is an automated option for crypto trading. The platform works by connecting an online crypto wallet to the platform. Then the user sets up ‘buy and sell’ parameters for the automated software. The platform then charges a commission per transaction made using their system.

4. Gekko

Named after the iconic antagonist Gordon Gekko the platform is an open-source trading bot. The project has a GitHub repository that is updated regularly, and it is supported in operating systems such as Linux, Windows, and macOS.

Right from the get-go, the bot has backtesting capabilities to allow the user to test run different strategies under past market conditions. It comes ready with a web interface to track trades across different exchanges and monitor performance.

Finally, it can be configured to send alerts to your social media platforms if an event pre-programed has happened. This could be a drop in price or vice versa.

Right now, it can be used with Bistamp, Bitfinex, and Poloniex. Since it is an open-source project, it is free, but this also means more work setting it up.

5. BTCRobot

This is a trading bot created as a software. It is not supported on a platform such as eToro or something similar. It works on a renewable monthly license for the silver and gold plan. The former priced at nine-teen dollars while the latter is thirty-nine dollars.

It can be set up using sets of data for various strategies. It also has a prediction algorithm that creates multiple forecasts of price movements based on past conditions.

The bot is easy to install, but it does have a very extensive manual attached to it. Some of the basic functions are easy to understand, but training and forecasting are somewhat technical. This may not be the most friendly option out there.

6. Zenbot

Zenbot is another open-source project for crypto trading. It supports all three major operating systems Linux, Windows, and macOS. The base of the bot is a neural network that adapts to new strategies based on market conditions. As such, it can be configured using past market data for various strategies and also for High-frequency Trading.

Right now, it works with Bittrex, Gemini, GDAX, and Quadriga. It is, of course, free to use, but it is very technically challenging. The bot has no user interface, so all the interactions have to be done using a command line.

We have all thought at some point of using trading as a way to supplement our incomes. There are risks involved with the strategy, as trading can never guarantee a return. The world of cryptocurrencies is extraordinarily volatile and can lead to massive losses. An automated trading bot can minimize those losses when programmed correctly.

Despite all these, there is still a continuous argument in the shadows between miners and traders on which gives a better return on investment – mining of cryptocurrency or trading it. Check out the article to find out.

As the market increases in complexity and speed, any edge a trader can get is welcomed. Right not over 75% of trades in crypto exchanges are made by automated bots.

This will only increase in the future as the technology becomes more affordable for the average trader. If you are thinking of trading at a professional level, implementing bots in our strategy is a must for future success. Even if you want to trade on the side, a bot can help you earn while at work.