As we enter the third decade of the 21st century, it’s safe to say that much of our everyday lives has changed very quickly. In particular, the prevalence of technology has shifted how we approach our day-to-day.

While we might not be flying in hovercrafts or living in space, a la Hollywood impressions, we certainly spend vast amounts of time on our phones and can video call with people all over the world at a moment’s notice.

Technology has shifted how we live in momentous ways and our device usage only increases with Statista projecting that our mobile internet consumption will increase to 155 minutes per day in 2021.

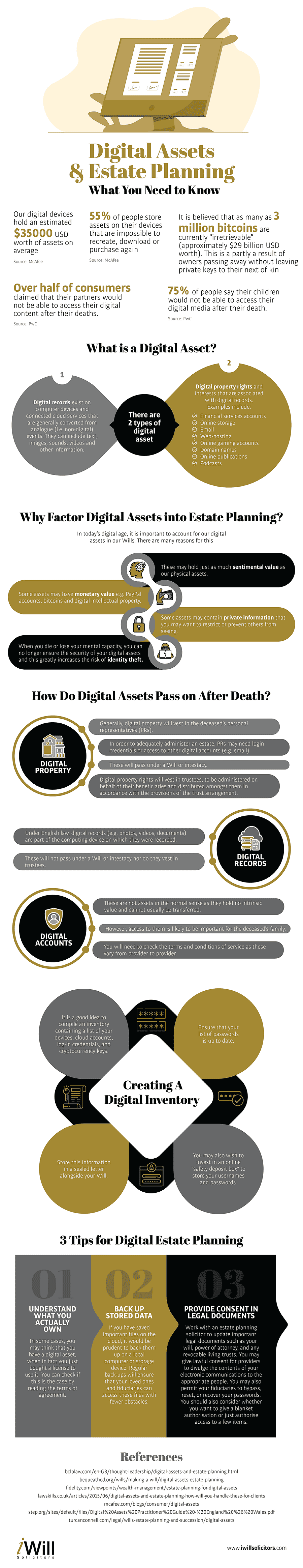

Even with mass adoption of technology, one aspect of life that we’ve possibly forgotten that needs revision alongside our digital uptake is how this affects our wills and overall estate planning. Nearly everyone will have digital assets of some kind whether it’s purchased items like media, cryptocurrencies, and even files.

Writing for Forbes, Cheryl Winokur Munk says,

“The trouble is, even when estate planning documents contain provisions for digital assets, locating the various assets can be a time-consuming and arduous task for executors if the decedent hasn’t properly prepared.”

Building on this, there are numerous points of risk tied to not including your digital assets into your estate planning. From how this can affect loved ones through to being targeted by digital thieves who comb death notices, your planning incorporates items to ensure you’re adequately prepared for any essential steps for organisation and security.

I Will Solicitors developed this infographic ‘Digital Assets and Estate Planning’ to help people understand the importance of this area of life planning. For 2020 and beyond, read on for key information and recommendations that explores how to address the different components of your digital accounts, files, and purchases.

Read on for the full graphic and to start taking steps towards reviewing this essential life administration.