Before I move into the details of how I flipped a $100 to $2000 in a month on BTCC crypto derivatives trading platform, let me first go over what it means to trade bitcoin CFDs on margin, which played a crucial role in getting me that kind of profit within such a short period.

Also, not forgetting to mention market timing. I’ll touch on market timing but, let’s start by explaining what it means to trade cryptos on leverage, which is also referred to as margin trading.

Margin trading involves taking leverage, which is like a boost to your trading account. With leverage, you can quickly buffer up a small account size, controlling more volume/lot size.

After observing the success of Bitcoin BTC as a retail trader, I started looking for ways to get into the crypto market and be able to take both long and short positions, without the burden of safely securing private keys and other techie stuff involved in the space.

Enter BTCC, a crypto exchange that allows the trading of CFDs, which are derivatives of the underlying cryptocurrency. With crypto derivatives, I get to trade the crypto markets without going through the trouble of storing private keys, and I can take either buy or sell trades, betting on the primary trend direction.

Where it all started

Now let me share my success story of how I flipped $100 to $2000 on the BTCC crypto exchange.

So, after buying altcoins at the end of the 2017 bull run and suffering some loss in the crypto winter of 2018, I decided to follow a more strategic approach to trading Bitcoin. Only this time, I needed a broker that offered leverage, allowing both long and short orders.

I discovered BTCC Exchange, and then I moved to the right entry point on the BTCUSD perpetual futures contract.

Weekly Chart Analysis

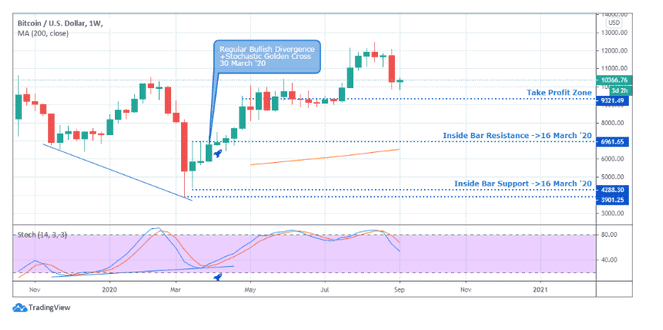

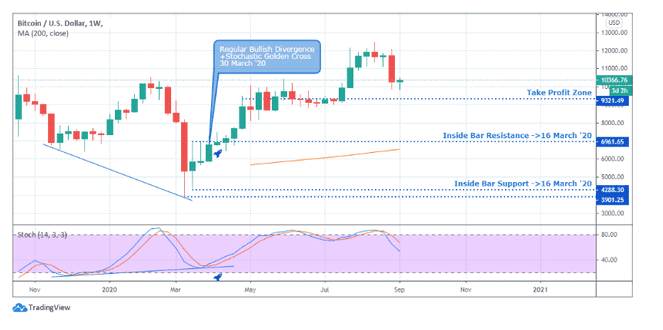

Following previous Bitcoin BTC halving events, I noticed that the crypto giant would attract many interest weeks before the halving date on May 11, 2020. So I waited for a moment when the Bitcoin price would tank, get a technical chart formation to confirm a rebound, and jump into the bullish trend.

Finally, I had my chance, and I took it. After signaling an Inside-bar candlestick pattern, the BTCUSD signaled a regular bullish divergence formation using the stochastic oscillator.

First Order Entry Level ($6906.09) Weekly TF

I wasn’t going to simply jump into a trade based on a single formation. I waited patiently for a golden cross of the Stochastic oscillator. I ensured that the price was trading close to the child-bar resistance before moving to initiate my order on the BTCC crypto exchange platform.

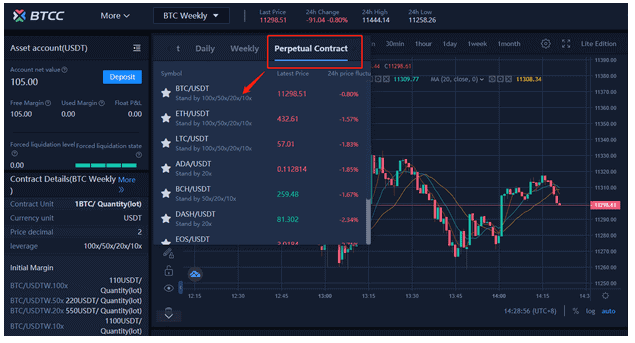

Signing into my BTCC exchange account, I selected the Crypto perpetual contract. Unlike the default regular futures contract, there’s no limitation on my position’s holding time (no expiration time) so long the minimum requirements are met.

BTCC offers a good range of leverage for daily, weekly, and perpetual crypto contracts on BTCUSDT, ETHUSDT, LTCUSDT, EOSUSDT, etc., ranging from 50X, 100X, and 150X.

BTCC Crypto Exchange Trade Terminal

I chose the 50X leverage considering that I had much confidence in the confluence of events and the market structure at the time, plus any wanted to avoid a sudden account liquidation in the case of unexpected market whipsaw.

Second Order on Daily TF

Upon establishing the market direction from a higher time frame (Weekly chart) and initiating my first trade on April 06 ’20, I needed to maximize the trend and look for ways to scale into the movement. So, I zoomed in to the lower daily time frame for more precise entry points and only making sure that I took trades while I was in a profit.

The second order was opened while the BTCUSD traded at $7700.50 on April 26 ’20, from where I continued to take a trade on every trading day since the entry of the overbought area with so much support from the higher weekly time frame only means a continuation of the trend.

The trades taken in this price formation buildup was responsible for landing me $2000.00 within a month. The BTC halving date finally came, and unlike an anticipated price slump on the weekly time frame, the price entered into a range, reinforcing that miners are not willing to part with their BTC holdings.

Finally

After securing my profit by closing the open positions around the $9400.00 mark, I was left to cash out on my earnings.

BTCC made the withdrawal process seamless as my withdrawal hit my bank account in no time.

So if you’re looking for a reputable crypto broker to trade crypto CFDs that offers daily, weekly, and perpetual futures contracts on BTCUSD, ETHUSD, LTCUSD, etc., then look no further.

Go for a free account on BTCC in seconds and make your first crypto leverage trading. The deposit amount is as low as 0.5 USDT. And if your first deposit is 500 USDT or above BTCC will give you a bonus of up to 2000 USDT.

Note: The futures contracts on BTCC are USDT-margined, and that means you need to have USDT to do the trading.

Tip: If you like to trade on the go, you can download BTCC Mobile APP which will give you a better trading experience than the web.

Related Topics

- Understanding Forks in Cryptocurrency

- Best Cryptocurrency Learning Resources

- Africa: The Playground for Scammers of Cryptocurrency

- What is Ethereum?

- How Digital Learning will aid Education and Employment System

- What is the Official website of Bitcoin Loophole?

- Remitano Launches Mission

- Is Remitano P2P the Remedy for Nigerians to Buy Bitcoin in Nigeria?