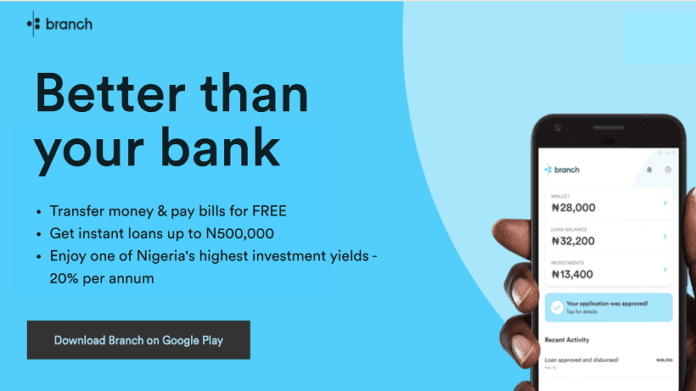

Africa’s leading finance app invites Nigerians to compare and save

With over 23 million downloads, Branch is one of the most popular lending apps in the world. The app now offers 2 new noteworthy services:

- Unlimited free money transfer (unmatched amongst today’s finance apps)

- 20% per annum investment returns (amongst Nigeria’s highest)

These new offerings complement instant loans up to N500,000, free bill pay, airtime top ups, and other existing services found within the app.

Taken together, customers can now enjoy a single app to manage their money with unmatched value.

“Finding the best deal when it comes to your money can be overwhelming. We have made it simple. Compare our 20% returns and free money transfers to see how Branch is better than your bank”

says Dayo Ademola, Managing Director of Branch Nigeria.

A Better Deal — What’s the catch?

No catch.

Branch’s unlimited free transfers to recipient bank accounts have no hidden fees or restrictions. Most financial apps today charge a transfer fee or cap the number of free transfers.

Unlike other investment platforms where the money is locked for a fixed period, our customers can withdraw their investments after a 24-hour period. Branch’s 20% per annum return is paid weekly.

Investments through the Branch app are channelled into low risk financial instruments with capital preservation as the ultimate goal. Branch also forfeits its commissions to customers in order to provide returns that are amongst Nigeria’s highest.

To further encourage new customer trials, Branch is offering a limited time additional incentive: for each deposit of N300 or more using the wallet, customers receive a N50 bonus – up to N6,000 in bonuses per year.

There are so Many Apps. Why trust Branch?

Branch is licensed by the Central Bank of Nigeria as a Finance Company and authorised to provide services such as credit and fund management. Over 23 million people have installed Branch’s app with a 4.4 star rating by over 300,000 reviews on Google Play.

Branch is backed by some of the world’s biggest investors, including Andreessen Horowitz (early backers of Facebook & Twitter) and Visa. Since 2018, Branch has provided over 3 million loans to Nigerians and is now expanding to offer 20% investments and free money transfers.

About Branch

With over 23 million downloads, Branch is a leading finance app that provides Nigerians access to instant loans, free money transfers, bill payment, and an investment platform that offers a 20% interest rate per annum, all in one place.

In addition to Nigeria, Branch International has offices in Kenya, India, and Silicon Valley. Founded in 2015, its mission is to provide world-class financial services to the mobile generation.

The Branch app is available on Android devices and can be downloaded on the Google Play Store. Learn more at Branch.com.ng.