Yellow Card, the American VC-backed crypto exchange with a target on the African market, has resumed operations in Nigeria. With a revamped app and addition of new features like KYC that makes it more compliant with international best practices, Peer-to-Peer (P2P) solution, and USDT support, Yellow Card is positioning itself as the go-to app for anyone who wants to buy and sell Bitcoin and USDT in Nigeria using the Naira.

With the restrictions on cryptocurrency trading through Nigerian banks, Peer-to-Peer (P2P) has emerged as the crypto trading solution for the vast and still rapidly growing Nigerian Cryptocurrency community. The addition of P2P service in the relaunched app, means Yellow Card is now well positioned to take-on the Nigerian crypto market.

Over the last couple of days, we have been exploring the new app and will be sharing our experience in this article. In this Yellow Card review I would investigate how easy it is to buy and sell Bitcoin and USDT in Naira.

How to Download the Yellow Card App

The Yellow Card App is available for both Android and iOS. Just visit the Google Play Store or App Store to download the app. Once fully downloaded and installed, you can now launch the app.

Setting Up the Yellow Card App

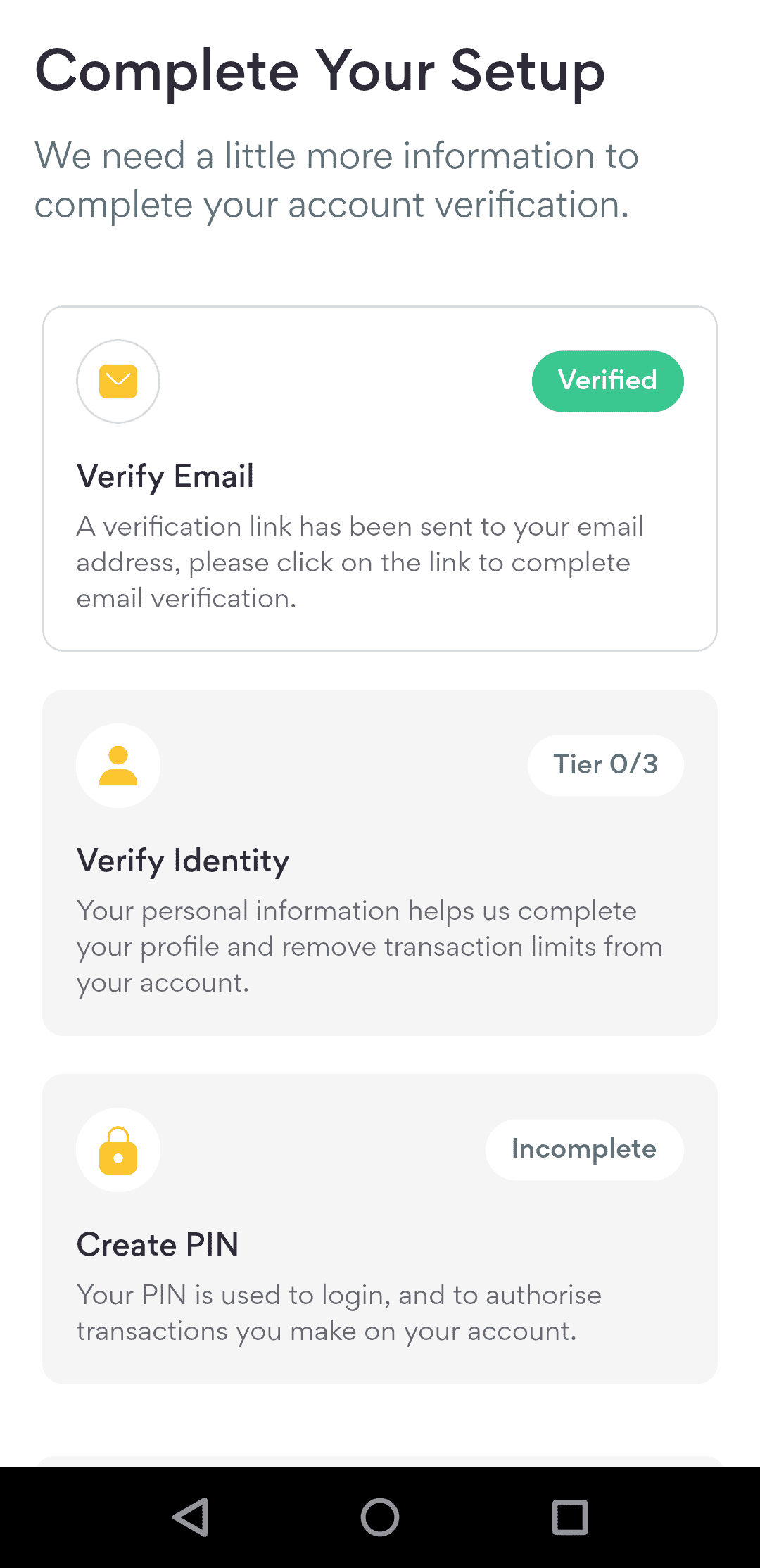

The first time you launch the app, you will be required to create an account. You signup with your email address and password. At this point, you can login but you cannot do much until you take some steps.

You will be required to verify your email address by clicking a verification link sent to the email address. You will also be required to create a PIN. The PIN will be required for authentication during login and confirmation of some transactions.

Verify your Identity

KYC (Know your Customer) is a new feature added to the revamped Yellow card app. It is a crucial part of the setup of the app because without it you cannot conduct any transaction on the app.

KYC is a service that enables a financial services provider to verify the identity of its customers. This is done by requiring the customer to provide some relevant documents and details that will aid in the processes of verifying their identity.

This enables the service provider to protect itself and its customers from exposure to fraud and being used for illicit activities. This new KYC service means you can transact with confidence on Yellow Card knowing that everyone using the app has been verified.

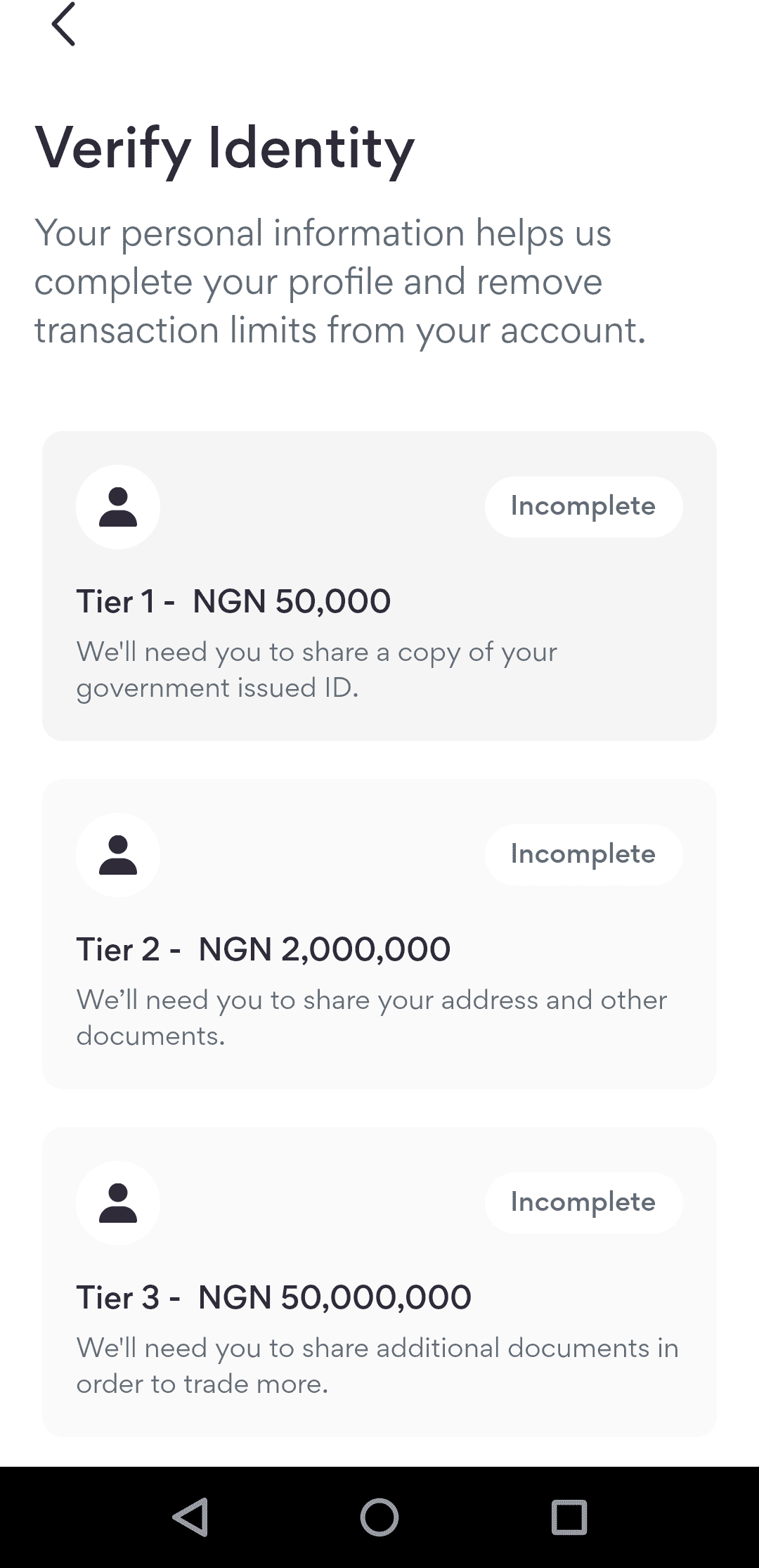

Yellow Card offers three tiers of KYC verification, each level offering a customer a higher trading limit on transactions.

Tier 1

This is the entry-level tier and has the lowest barrier to entry. All you are required to provide to get verified in this tier is a valid means of identification (i.e., a government issued ID card). Your NIN or BVN will also do for verification in this tier.

A successful verification to tier 1 enables you trade up to 50,000 Naira.

Tier 2

To get upgraded to tier 2, you need to provide proof of your address. A successful verification increases your daily trading limit to up to 2,000,000 Naira.

Tier 3

Tier 3 enables you trade up to 50,000,000 Naira daily. You will be required to provide proof of income to get verified and upgraded to this tier.

If verification is successful, you will receive and email notifying you. For the purpose of this review, we verified for tier 1. The process took just a couple of minutes and was seamless.

Once verification is done, you can now fund your wallet with Naira and begin buying and selling Bitcoin and USDT.

Funding your Yellow Card Wallet

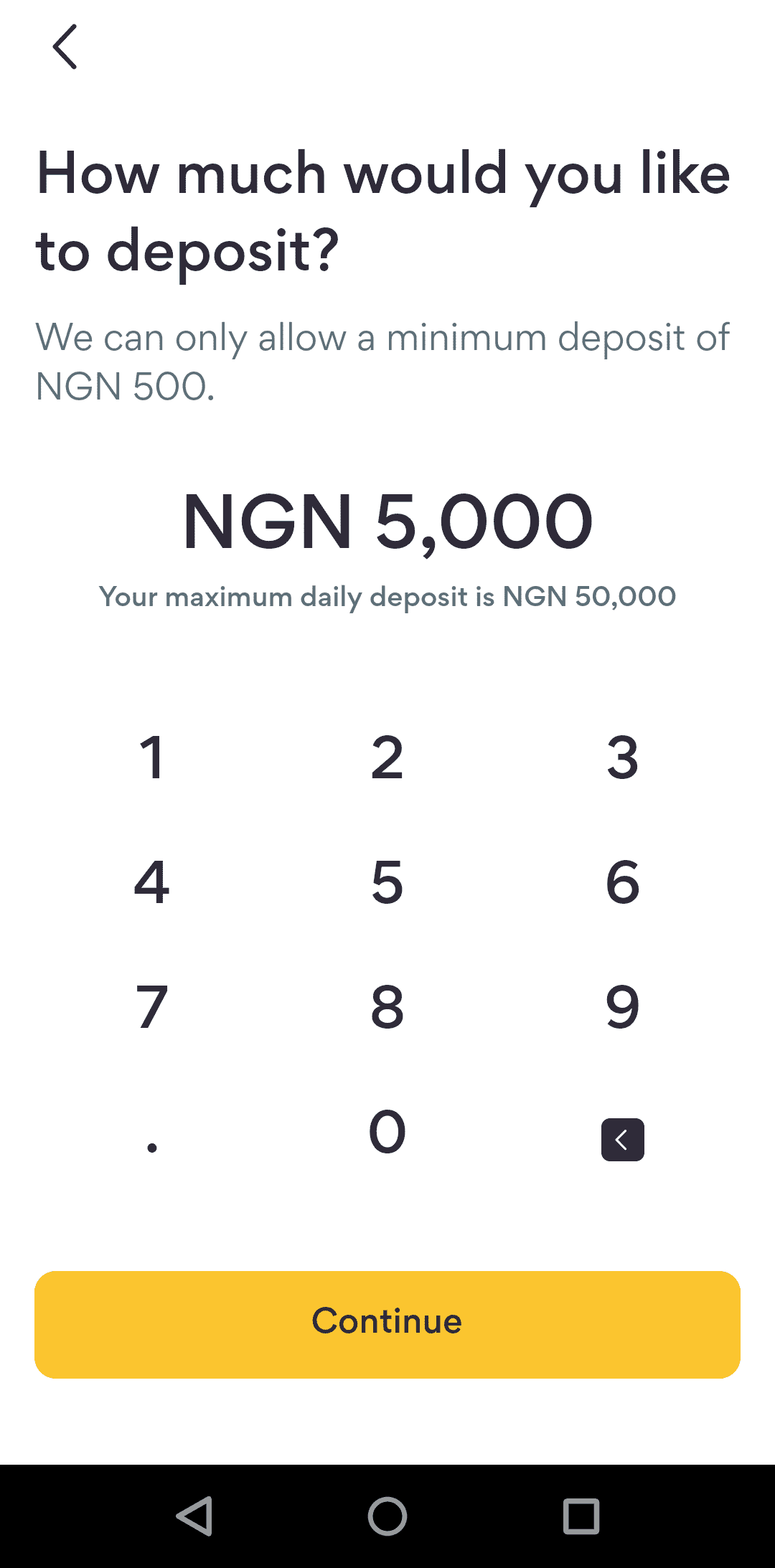

The first step to trading cryptocurrencies on Yellow Card is to fund your wallet. The amount you can deposit depends on the limits of your current tier. For example, for tier 1, this will be ₦50,000. The minimum amount you can deposit is ₦500. There is no transaction fee for depositing fund in your Yellow Card wallet.

Funding your Yellow Card wallet is easy. Here is how to fund your Yellow Card Naira wallet:

Step 1. Tap on the yellow Deposit button

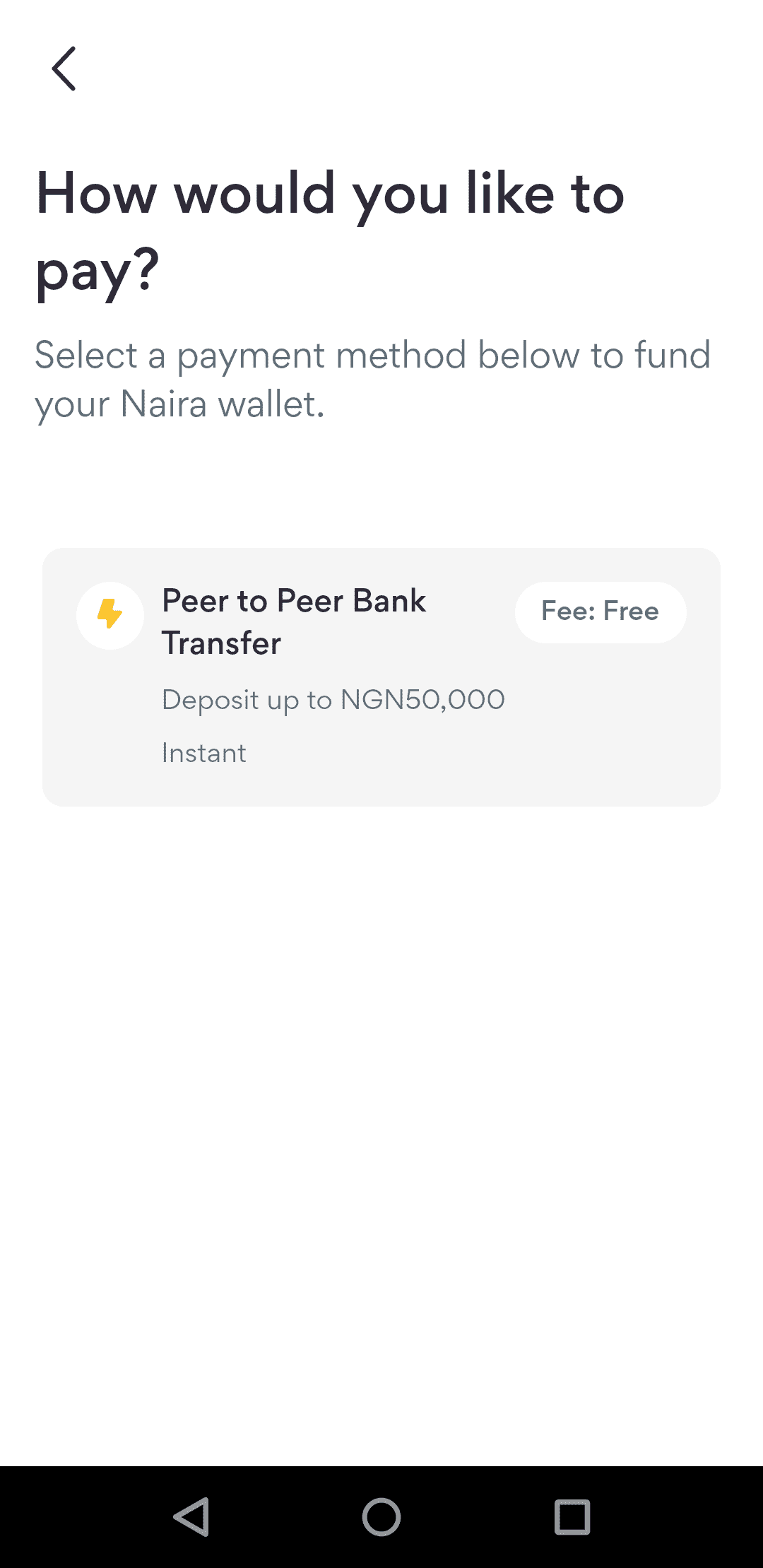

Step 2. Tap on Peer to Peer Bank Transfer

Step 3. Enter the amount you want to deposit within the limits of your current tier and tap the Continue button.

Step 4. Tap on the Find a Match button. You will be matched with another user ( a merchant) who would transfer the fund into your account. However, first you have to transfer the amount to the account of the user, and they will then fund your account. You will be provided with all the details you need to transfer the payment into the users.

Step 5. Transfer the exact amount you want deposited to your Naira wallet to the merchant’s account using the details provided in step 4 and then tap on the I’ve completed the transfer button to notify the merchant and Yellow Card. Do not forget to add the phone number as provided in the instruction as the transaction description when doing the transfer.

Step 6. Tap on the Done button and wait for confirmation which during my review took less than a minute in every case.

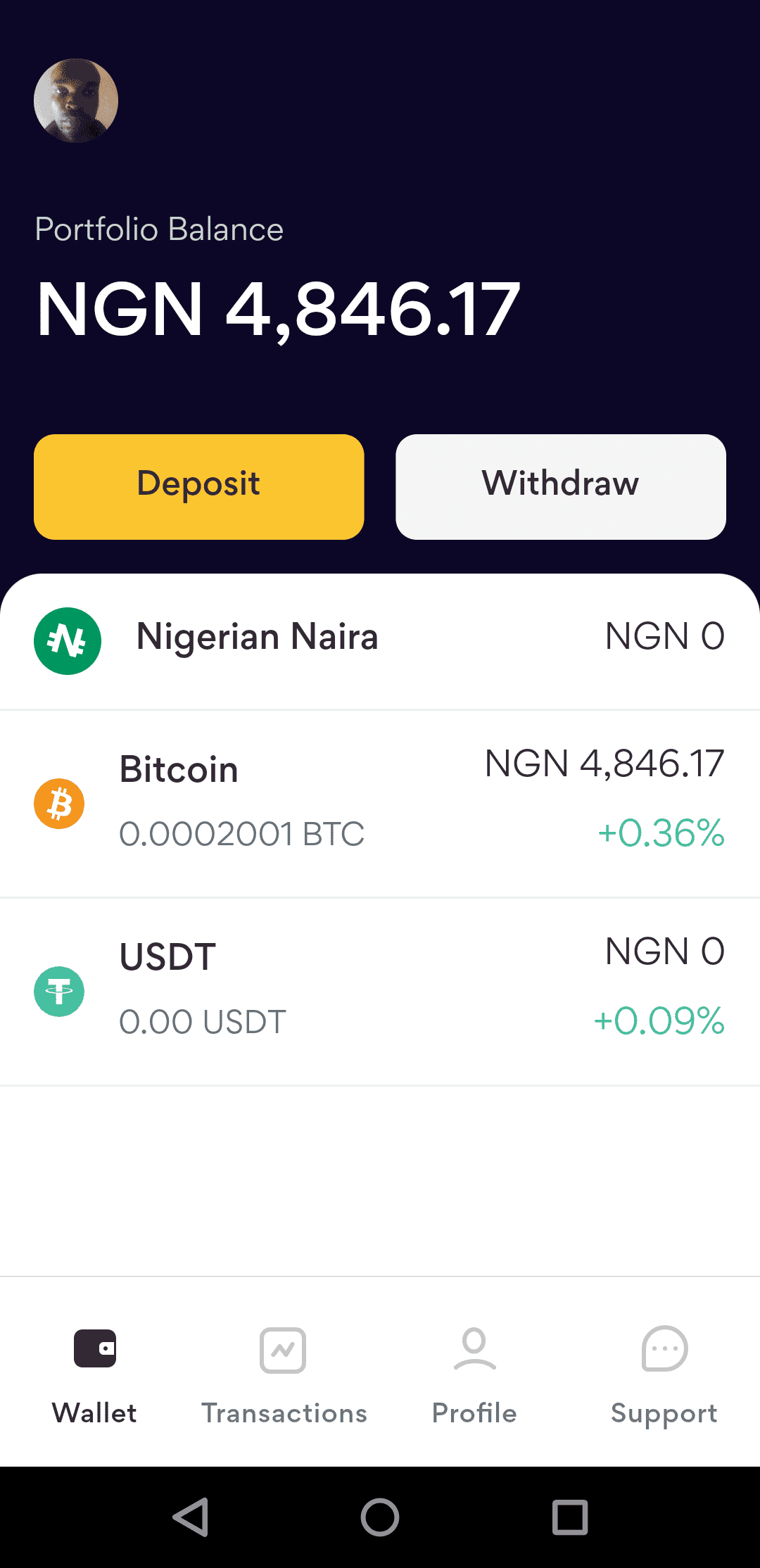

You should now see the fund in your account.

From the description above you can observe that the deposit of fund is done via Peer to Peer, which means that Yellow Card does not directly fund your wallet, rather they created a platform to enable users (merchants) fund the wallet of other users.

However, you may be tempted to ask what if after transferring to the bank account of the user they fail to fund your wallet? This is where the KYC comes in, by knowing who each user is and limiting the level of transactions they can undertake, they create a safe platform for P2P transactions.

Peer to Peer trading / transactions involves users buying and selling items from each other on a platform that support them. It can be risky if not well implemented, but Yellow Card seems to have managed to create a platform that is safe for P2P transactions.

The system automatically matches you with verified merchants who have enough funds in their wallet to fund your wallet with your required amount.

Buying Bitcoin or USDT on Yellow Card

With your account funded with Naira, you now have all you need to buy Bitcoin or USDT on Yellow Card. Here is how

Step 1. Tap on Bitcoin or USDT in your wallet summary.

Step 2. Tap on the yellow Trade button. You will be provided with the details of the transaction for confirmation.

Step 3. If all checks out, tap the Confirm button. You will be informed if the purchase was successful.

Step 4. Tap on the Done button to complete the transaction.

The purchased Crypto will be in your wallet in seconds with zero transaction cost. Once you have Bitcoin in your wallet, you can either sell it for cash or you can transfer it to another Yellow Card user using just their phone number or email, or directly to their wallet.

Selling Bitcoin or USDT on Yellow Card

Selling Bitcoin or USDT on Yellow Card is easy and comes with zero transaction costs. Here is how to sell Bitcoin or USDT on the Yellow Card App.

Step 1. Tap on Bitcoin in your wallet summary to open the trading page.

Step 2. Tap on the yellow Trade button to begin the trade.

Step 3. Enter the amount of Bitcoin in Naira that you want to sell, and tap on the Continue button. You will be provided with the details of the transaction for confirmation.

Step 4. Tap the Confirm button to authorize the transaction. You will be informed if the purchase was successful.

Step 5. Tap on the Done button to complete the transaction. The fund will be immediately moved to your wallet.

Withdrawing Fund from your Yellow Card Wallet

You have traded some Bitcoin made some profit or made some Forex gains on your USDT holding and now want to take your gains? You can easily withdraw any amount from your Naira balance. This comes with a transaction fee of just ₦100.

Here is how to withdraw fund from your Yellow Card wallet:

Step 1. Tap on the white Withdraw button on your wallet

Step 2. Tap on the Peer-to-Peer Bank Transfer.

Step 3. Enter the amount you want to withdraw and tap the Continue button. If you have not already saved the bank account, you will now be required to add a bank account. Do not forget to check Save bank account details option if you will be using this account again for withdrawal in the future. Once you have successfully added your bank account, you would be provided with details of the transaction. A transaction fee of 100 Naira will be deducted, so make provision for this when entering the amount, you want to withdraw.

Step 4. Enter your PIN and then tap the Find a Match button. The system will look for a match and submit the withdrawal notice. In less than a minute, the fund should be in the bank account you provided.

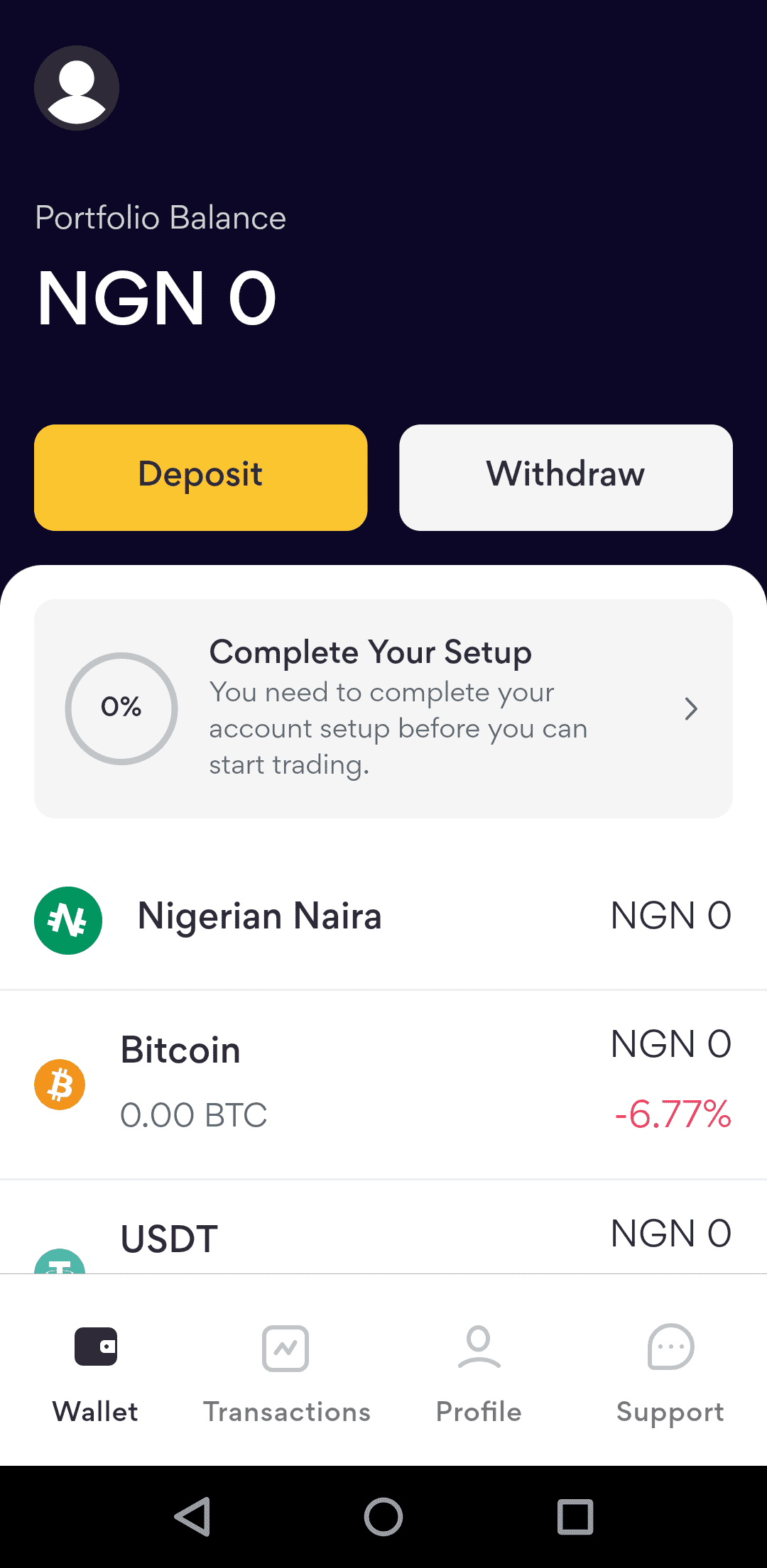

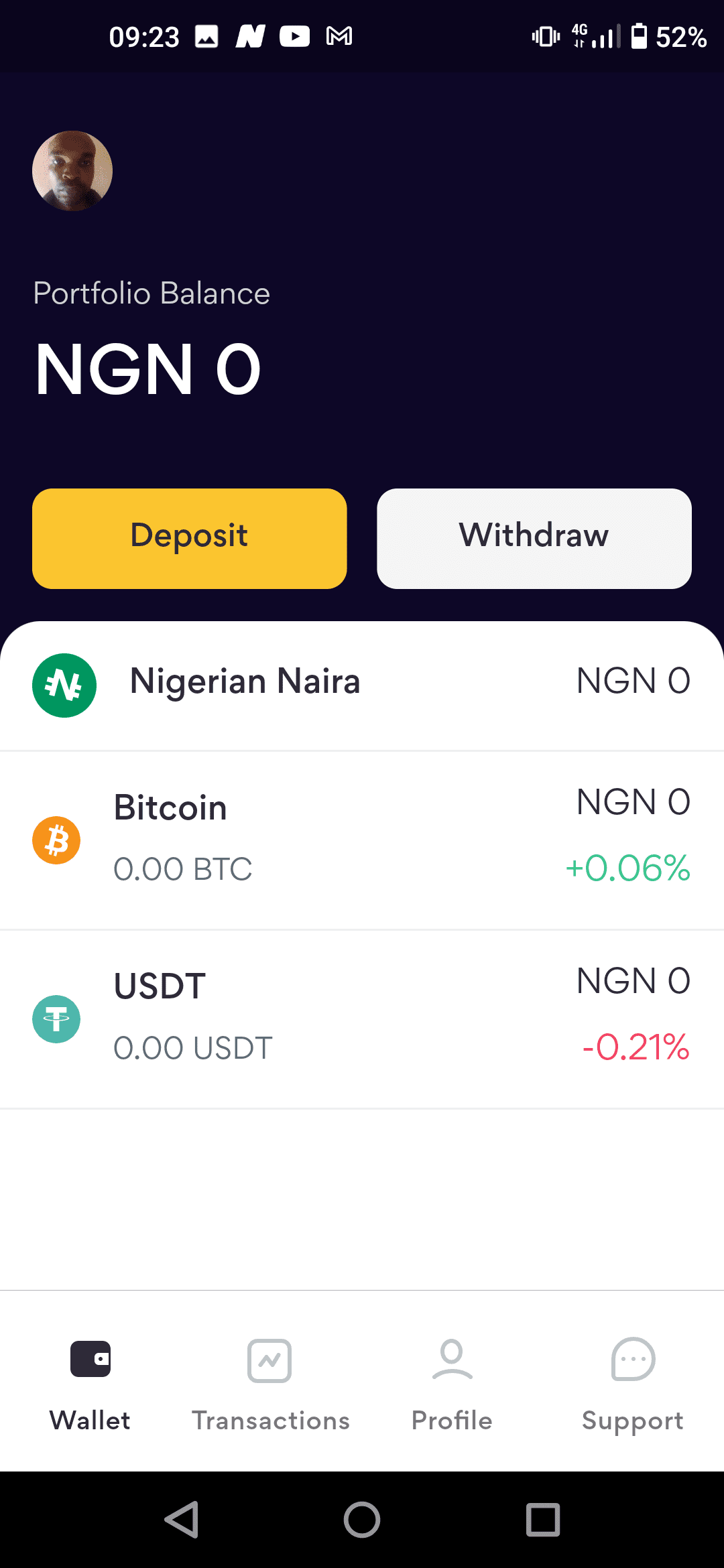

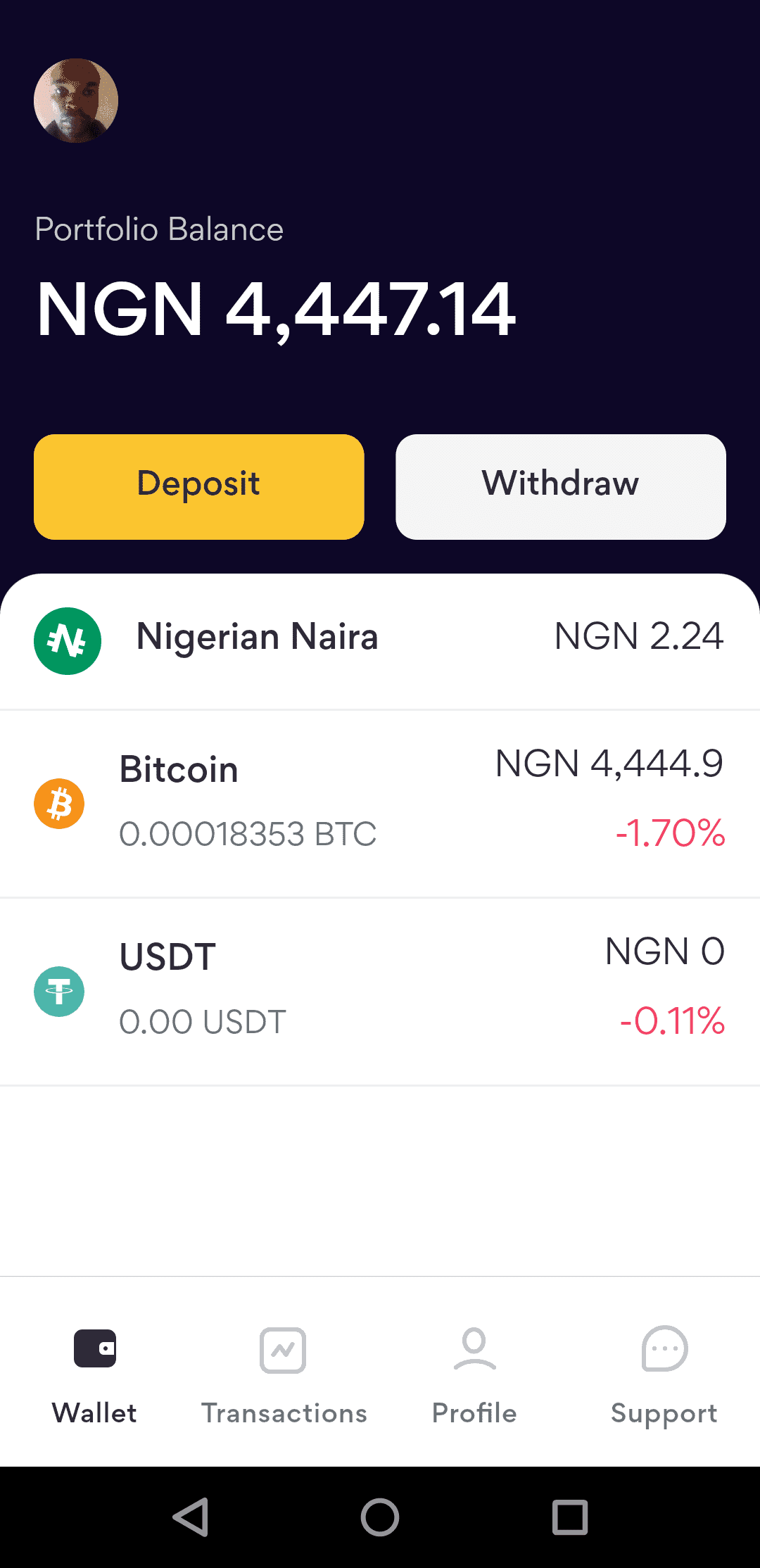

An Intuitive Interface

The new Yellow Card app offers a clean and intuitive interface with no clutter or confusion. You will clearly see your portfolio balance. Then the two big buttons to deposit or withdraw. You will also see your balance for Naira, Bitcoin, and USDT in your wallet.

The four icons at the lower end of the interface are self-explanatory. The Wallet icon takes you to your wallet balance, Transaction icon displays summary and details of all your transactions, and the Profile icon shows your identity and your tier. You can also access the Refer and Earn option where you invite friends to Yellow Card and 20% commission for fees when they buy or sell Bitcoin or USDT.

The final icon is Support. This is where you go to if you run into any issue. Never had to use support during my review because everything worked as expected.

You can also visit the Yellow Card Academy for easy to follow guides on different crypto and Blockchain technologies as well as guides on how to make money from cryptocurrency investment.

Conclusion

The revamped Yellow Card app comes with new features to easily adapt to the Nigerian cryptocurrency space. The introduction of KYC and P2P means the app can continue to offer services to Nigeria’s rapidly growing cryptocurrency community.

Another great addition to the latest update is the introduction of stable coins with USDT now supported. This makes it a great platform if you want to hedge against inflation the never-ending loss of value experienced by the Naira.

Related Topics

- How to Buy Bitcoin in Nigeria

- Best Places to Buy and Sell Bitcoin

- Top 5 Criticisms Labelled Against Bitcoin by Governments

- Everything you need to Know about Bitcoin Exchanges

- What is a Stablecoin and How Does it Differ from other Cryptocurrencies

- Top Bitcoin Exchanges you should Know in Nigeria

- Common Cryptocurrency Jargons you Need to Know

- Top Less Risky Cryptocurrencies as an Investment