Big money has always caused the lure of fraud and theft, long before the advent of the internet. Since it became a technology without which we can no longer live, the e-commerce and retail industry has become one of the most profitable and fastest-growing areas, as it covers almost all types of business.

The more companies go online, the more valuable data they generate, which means they become attractive victims for online scams. Is there a way to protect yourself and your business? Fortunately, there are a lot of them.

In this article, we will discuss the main methods for eCommerce fraud prevention you may start following right now.

What Are the Risks and Frauds Which Happen Online?

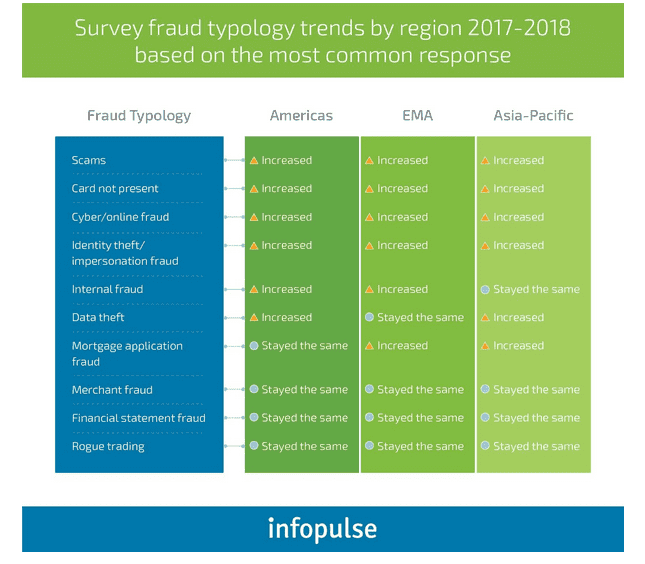

The issues of e-commerce fraud detection and prevention are especially relevant in 2020 and 2021 since the recent coronavirus pandemic opened up a lot of free space for fraudsters to operate. There are a lot of scam attempts to earn money on this anxiety-provoking topic, but as for eCommerce fraud, its typology remains the same for several years.

Below is one of the approaches to the eCommerce fraud classification.

- Scams. Scams may be understood as a collective term that covers all types of online theft and fraud.

- Card not present. As a part of this financial fraud, a fraudster doesn’t need to have a card of his victim. As a rule, banking credentials and access to a mobile phone are enough.

- Cyber/online fraud. This is one more collective term that covers all the other types of fraud. Cyber Fraud is always referred to as data theft while online fraud can take the forms below.

- Identity theft. In this case, criminals gather all the available information about the victim using open sources, social media, email hacking services, all types of tracking apps, and malware to create a personal picture of the user and make financial transactions on his/her behalf.

- Internal fraud. In this case, the in-house employees of an eCommerce (or any other company) acts like fraudsters by selling data to competitors, overpricing the goods, or stealing them.

- Data theft. This is one of the most popular fraudulent schemes since sometimes data is even more valuable than money and/or goods. What’s more, there are companies whose data is especially valuable, for example, those healthcare providers who operate in the field of eCommerce too.

- Mortgage application fraud. As the name implies, in this case, a fraudster applies for a mortgage using fake or stolen personal and financial data to increase his chances of obtaining the loan. Also, fraudsters can apply for consumer loans, for example, to buy home appliances in instalments. Of course, no one is going to pay off this debt, and this type of fraud is becoming a problem for both retailers and banks. In this case, it makes sense to use the fraud prevention application. You can choose either a ready-made solution (below we will give you an overview), or contact a reliable vendor, for example, SPD Group, to create a custom solution to protect your business from fraudulent attacks.

- Merchant fraud. In this case, distributors can set prices higher than those set by the contract with their supplier, and such overpricing can be also discovered with the help of fraud detection services.

- Financial statement fraud. In this case, the company deliberately hides its real financial capabilities, for example, in order to declare itself bankrupt and evade responsibility.

- Rogue trading. This is one of the subtypes of internal fraud in which an employee of the company commits unauthorized transactions with money or goods, and also engages in criminal conspiracies with other employees or partners of the company.

Why Is Fraud Detection Important?

According to the Comprehensive Survey of Data Mining-based Fraud Detection Research, “It is impossible to be absolutely certain about the legitimacy of and intention behind an application or transaction.

Given the reality, the best cost-effective option is to tease out possible evidence of fraud from the available data using mathematical algorithms. ”

Thus, ML and AI-based fraud prevention solutions allow securing business from

- financial

- inventory

- reputational risks.

As we have said, depending on the type of fraud, the original target may be money, goods, or data. But even regardless of the purpose of the fraud, the company’s reputation suffers significantly, and these losses cannot be measured qualitatively or quantitatively.

eCommerce fraud prevention becomes especially important when money and customer data is lost or stolen, restoring a company’s reputation will be extremely difficult, and sometimes even impossible.

How Does Fraud Detection Software Work?

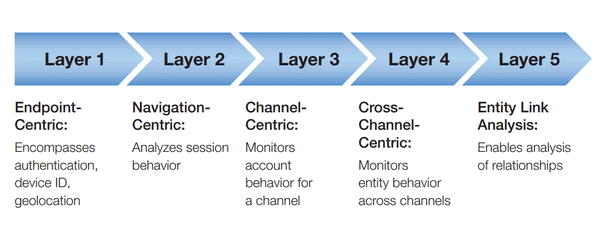

The infographics below explain the algorithm according to which eCommerce fraud prevention software works. As you can see, it works at every level of user and system interaction, analyzing the smallest details – from geolocation to features of user behavior.

After that, the system compares its knowledge about the typical behavior of a specific buyer and concludes whether it is fraudulent or legitimate.

Important! Fraud prevention services allow you to recognize fraud at the stage of intent, that is, an attempt can be completely prevented without risks and losses for the company.

How Can Ecommerce Fraud Be Prevented?

Before we proceed to eCommerce fraud detection services, take a look on this checklist and make sure that everything is ok with your security measures one more time.

- Check your own security

- Educate your staff

- Use credit card security codes

- Require customers to set up an account with you

- If in doubt, contact the customer

- Use tracking numbers for all orders

- Compare IP and email addresses

- Check shipping and billing addresses

- Require a signature on delivery

- Use a fraud protection service

Ecommerce Fraud Prevention Tools Comparison

So, if you want to connect eCommerce fraud prevention software to your online store, here are the best solutions on the market to choose from.

| Name | Features | Price |

| Subuno | This is a very user-friendly application that helps you to check each of your orders for legitimacy. There is no need for complex installations and integrations, plus it is used by leading eCommerce brands. | $19-249 per month |

| Riskified | As for this tool, eCommerce fraud prevention features come only as its part. It also allows for leveraging all the other risks on your customers’ path wishing your sales funnel. | Custom pricing |

| Fraudlabs Pro | This is a very powerful tool that will allow you to follow the best industry practices when it comes to fraud prevention, for example, user account verification, IP address checking, billing details verifications, and so on. What’s more, the tool may be used for free. | $0-1249 per month |

| Dupzapper | The main goal of this tool is to provide security if your customers use several accounts from several devices. Sometimes, this behavior can be quite legitimate, however, in all the other, this is a direct sign of fraud. This tool will help you to separate the wheat from the chaff. | Price by request |

| Kount | This is an all-in-one solution that will help you cope with account takeover, bot intruders, friendly and chargeback fraud, as well as reduce false-positive results. | Price by request |

Conclusion

So, the issues of protecting your online store with the help of eCommerce fraud prevention tools will be quite important in 2020 and beyond. What’s more, you have a lot of alternatives to choose from.

The easiest way to go is to use the already existing fraud prevention service, however, if your business has more specific protection needs, you should opt for a customized eCommerce fraud prevention solution creation.