OnePlus Nord CE 4 Specs, Price, Features and Best Deals

OnePlus recently launched its first Nord phone of 2024, the OnePlus Nord CE 4 as the successor to last year's Nord CE 3 with...

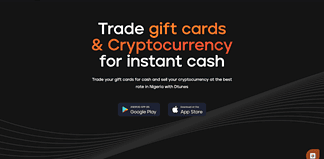

Sell Bitcoin: How to Sell BTC | Fast Cashout in Nigeria

As more people lose trust in fiat currency, the traditional and widely known means of exchange, many are now leaning towards receiving payment in...

How to Scale Your Business with Professional SEO Services

In today's digital age, where online visibility can make or break a business, search engine optimization (SEO) has become an indispensable tool for scaling...

Ulefone Armor 25T Pro Price, Specs, Features and Best Deals

The Ulefone Armor 25T Pro is a compact rugged 5G smartphone offering triple the performance of its predecessors. It features a large 6500 mAh...

Umidigi G6 5G Price, Specs, Features, and Best Deals

The Umidigi G6 5G is an affordable 5G smartphone released alongside the UMIDIGI G5A 4G smartphone in 2024. It has a 6.57-inch HD+ LCD display with...

Umidigi C1 Plus Price, Specs, Features and Best Deals

Umidigi C1 Plus is a budget-friendly android phone aimed at budget-conscious consumers who desire impressive performance, a sleek design, a large display, a decent...

Umidigi G5A Price, Specs, Features and Best Deals

The Umidigi G5A, launched on September 23, 2023, is one of the most affordable smartphones in the company’s lineup. It features a large 6.52-inch...

Challenges and Risks of Forming Strategic Alliances

Forming strategic alliances can propel businesses to new heights, but they come with significant challenges. Misaligned goals, cultural differences, and communication barriers can derail...

Effective Strategies for Short-Term Trading in Bull Markets

In a bull market, savvy traders can capitalize on short-term strategies to maximize their gains. Whether you're a seasoned pro or a beginner, understanding...

Determining the Right Mix for Your Financial Goals

Determining the optimal portfolio mix is key to achieving your financial goals. By diversifying your investments, you can balance risk and reward, ensuring steady...

Comparing Volume Trends In Bull Versus Bear Markets

Understanding volume trends in bull and bear markets can be the key to smarter investing. By examining how trading volumes shift with market conditions,...

Balancing High-Risk Investments With Safer Options

Balancing high-risk investments with safer options is essential for a stable financial future. This strategy can seem daunting, but with the right approach, you...

Analysis Of Market Liquidity And Investor Participation

Market liquidity and investor participation are the lifeblood of financial markets. Liquidity ensures smooth trading, while active investors drive market dynamics. Together, they shape...

Benefits of Market Orders in Algorithmic Trading

Market orders are indispensable for achieving speed and efficiency in trade execution. By executing trades instantly at the current market price, they allow traders...

A Comprehensive Guide to Setting Up Call Forwarding on Different Devices

Call forwarding is a handy but confusing feature. It helps with things like work-life balance, being unreachable, and managing multiple phone lines. However, setting...

Umidigi A15T Price, Specs, Features and Best Deals

UMIDIGI A15T is an entry-level smartphone launched alongside the UMIDIGI A15 Tab, to bridge the market between mid-range devices and the recently launched high-end...

ZTE Nubia Flip Price, Specs, Features and Best Deals

The ZTE Nubia Flip is currently one of the cheapest foldable smartphone strong enough to matches up to the Galaxy Z Flip 5, the...

ZTE Nubia Z60 Ultra Price, Specs, Features and Best Deals

ZTE Nubia Z60 Ultra is an ultra-big flagship smartphone with an all-screen design, an under-display front camera, and a fingerprint scanner with a triple...

Oppo A60 Price, Specs, Features and Best Deals

Oppo A60 is the company's new budget smartphone from Oppo’s A-series" with lot of the premium features at a very affordable price. The Oppo...

ZTE Nubia Red Magic 9 Pro Plus Price, Specs, and Best...

The ZTE Nubia Red Magic 9 Pro Plus is the higher variant of the Nubia Red Magic 9 Pro launched in 2023. It is...